Key Points

- Last week, Binance listed RON. This makes Ronin’s native token more accessible to millions of users, and increases depth for traders and investors. In part as a result of this new liquidity for RON, we’re making a few adjustments to the Katana Liquidity Mining Program rewards.

- In the past, we’ve shared our intentions to adjust the Katana Liquidity Mining Program rewards over time. Sky Mavis has always been prudent with emission of tokens, ensuring rewards are used in a measured way to target specific outcomes. That’s why we’ve determined that it would be in the RON token holders’ best interests to reduce the high level of inflationary rewards to Katana Liquidity providers. More information below.

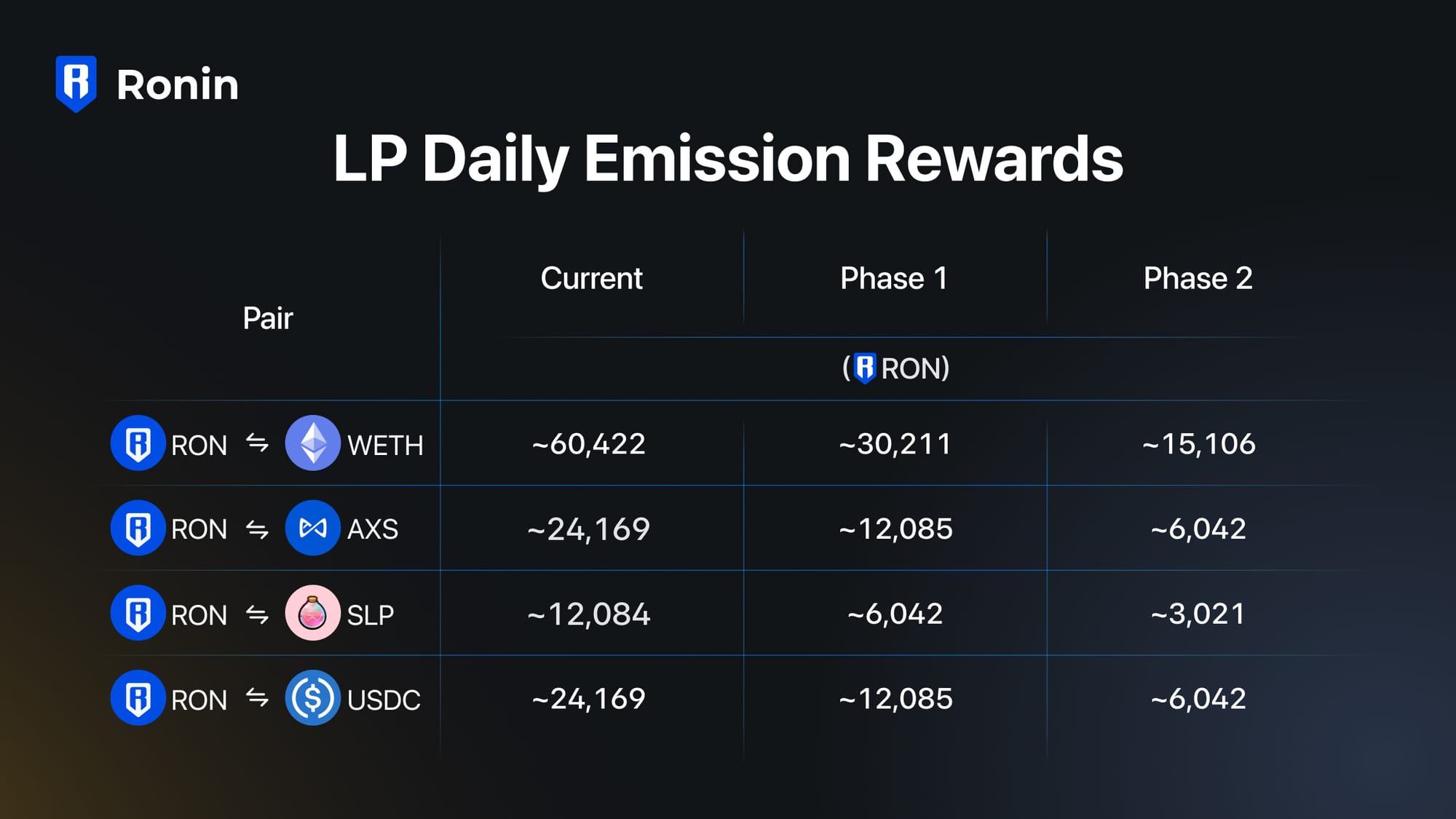

- If everything goes according to plan, we will begin a phased adjustment of rewards with Phase 1 on March 1st, 2024. See approximate figures for the 2024 Katana Liquidity Mining Program below.

Last week, Binance listed RON. After two years of relentless pursuit and unwavering support, a moment our community has been asking for arrived! We’re entering a new era together where Ronin’s native token is more accessible and has much greater trading depth. As a result, we’ve decided to update the Katana Liquidity Mining Program rewards following our most recent review. We also consulted with Ronin Governing Validators during this process. Here’s what rewards will look like going forward:

Katana Liquidity Mining Program Review

In the past, we’ve shared our intentions to adjust the Katana Liquidity Mining Program rewards over time. For example, we announced our plans to implement regular reviews in this December 2022 announcement. A few weeks later, we also transitioned rewards from WETH liquidity pairs to RON pairs. After many of these reviews, we often concluded that no action was necessary. Sky Mavis has long been prudent with emission of tokens, ensuring rewards are used in a measured way to target specific outcomes. Now, let’s dive into the observations and conclusions we made during our most recent review.

Over the past few months, average APR in Katana liquidity pools has increased from ~20% to 70%. The aggregate number of pooled tokens have not increased in proportion to the RON price to balance out the APR. This means the increase in reward value did not drive meaningful outcomes in DEX liquidity provision and may have gone past the optimal level of incentives.

At the current Katana emission rate, ~10.9M RON is emitted per quarter. Implementing Phase 1 alone would reduce emissions by over ~60K RON per day or 5.4M RON per quarter.

If we curb this over-incentivization, it will lead to less available inflationary rewards to sell, and supply & demand dynamics should lead to better equilibrium for token prices.

This will also lead to more RON allocation for other types of campaigns focused on user activations which leads to more user growth and corresponding increase in participation and value contributed across the ecosystem.

We considered these observations along with the improved liquidity profile of RON from exchange listings. As a result, we’ve determined that it would be in the RON token holders’ best interests to reduce the presently higher-than-required level of inflationary rewards to Katana Liquidity providers.

We will therefore begin a phased adjustment of rewards with Phase 1 starting at the end of February. Here are approximate figures for the 2024 Katana Liquidity Mining Program:

We understand our community may have questions around these figures. So, we’ve prepared a brief FAQ below. As always, feel free to let us know your feedback on X or Discord.

FAQ

Question 1

How will a reduction in incentives to provide liquidity through Katana affect the volume of fees accruing to the Ronin Treasury and participation in the Ronin ecosystem?

Answer 1

The reduction in RON reward emissions through the Katana Liquidity Mining Program may reduce the amount of passive liquidity provided on Katana DEX but it is yet uncertain whether it will result in fewer fees collected through Katana as that depends on volume and volume may remain higher. Ronin has multiple flywheels and the savings in RON will create more opportunities to reward projects that grow the Ronin ecosystem as a whole. As a result, this decision is beneficial to all token holders.

Question 2

How do the 2024 Katana Liquidity Mining Program rewards affect the supply of RON?

Answer 2

The total supply of RON remains capped at 1B. Today’s update will begin to reduce the rate of increase of circulating supply, which is a measure of tokens in the hands of users. While we will continue to emit rewards through initiatives like RON staking and even the Katana Liquidity Mining Program, the total rewards emitted will be smaller than before. Fewer emissions means lower inflation in circulating supply.

Question 3

How are you tracking the impact of this phased reduction?

Answer 3

We will continue to review the Katana Liquidity Mining Program structure regularly. We will look out for impact to on-chain liquidity profile & activity of liquidity providers. Implementation of the current update would save almost 2M RON in Q1 2024, which would then be available for campaigns targeting other parts of the Ronin flywheel such as user acquisition.