Key Points

- DeFi is coming to Ronin: Ronin is evolving into a full-fledged consumer chain where games, consumer dApps, and DeFi converge to create an embedded player economy – all with $RON at its core. We’re working alongside allies like Alpha Growth to supercharge DeFi on Ronin with a $13M growth program, fueling incentives and bootstrapping liquidity.

- What DeFi on Ronin Looks Like: Imagine plugging your gaming tokens and assets into DeFi dApps and unlocking new reward streams and utility. Borrowing against NFTs. Lending stablecoins. Liquid Staking. These are just a few examples of what’s possible through DeFi on Ronin.

- How to Get Started: Keep your eyes peeled for a few major announcements this quarter. The first protocols will go LIVE soon!

Ronin is evolving into a full-fledged consumer chain where games, social dApps, and DeFi converge into an embedded player economy – all with $RON at its core. With Ronin going permissionless, the floodgates are open for builders to launch DeFi protocols that will supercharge onchain liquidity, deepen user retention, and create a new wave of crypto power users. Here’s what that means:

Why DeFi? Why Now?

A robust DeFi ecosystem is the backbone of any thriving blockchain network. It keeps capital circulating within the network, driving self-sustaining loops of liquidity, utility, and user engagement. Ronin’s expansion into DeFi will grow the ecosystem in the following areas:

- Attract and Retain Liquidity – More earning opportunities bring capital into Ronin and anchor it within our ecosystem, ultimately increasing TVL and transaction volumes on chain.

- Enhance User Experience – New on-chain experiences, from yield-bearing assets integrated into games, to sustainable yield opportunities like liquid staking and beyond, become possible through DeFi.

- Onboard New Users – DeFi power users who come for the yield will stay for the content, discovering the games and communities that make Ronin stand out.

For more information on each layer, check out the appendix section below

What can DeFi on Ronin look like?

Decentralized Finance on Ronin is about more than earning yield: it unlocks a new utility network for gamers, investors, traders, and builders. In Web3 gaming, players own their assets – and DeFi can give them utility beyond the game. Here’s what that means for you:

- Earn Interest Beyond Staking – Maximize returns with native yield opportunities like liquidity provisioning and looping strategies. Even community-owned treasuries can generate revenue on their holdings.

- Programmatic Swaps – Enjoy the lowest fees aggregated from multiple DEXs with deep liquidity. Unlock features like limit orders, automated dollar-cost averaging, and recurring buys to enhance your trading experience.

- Borrow & Lend Assets – Use your idle token assets as collateral in lending markets to earn yield and unlock fresh liquidity without selling them.

- In-Game Yield – Earn and grow your holdings effortlessly with yield-bearing assets integrated directly into your favorite games—all from the same wallet like a high-yield savings account for players.

- Secure & Earn with Liquid Staking – Secure Ronin and Ethereum while keeping your staked assets ready for other DeFi opportunities.

Developers will soon have a flurry of composable DeFi tools with which to innovate on their game’s economies, reward systems, and spending. Protocols like Lumiterra’s Lumi Finance have already begun experimenting with DeFi and Web3 gaming.

For builders, tools like these can help you strengthen community loyalty. For players, you can get access to extra layers of engagement and rewards. Learn more about DeFi on Ronin here:

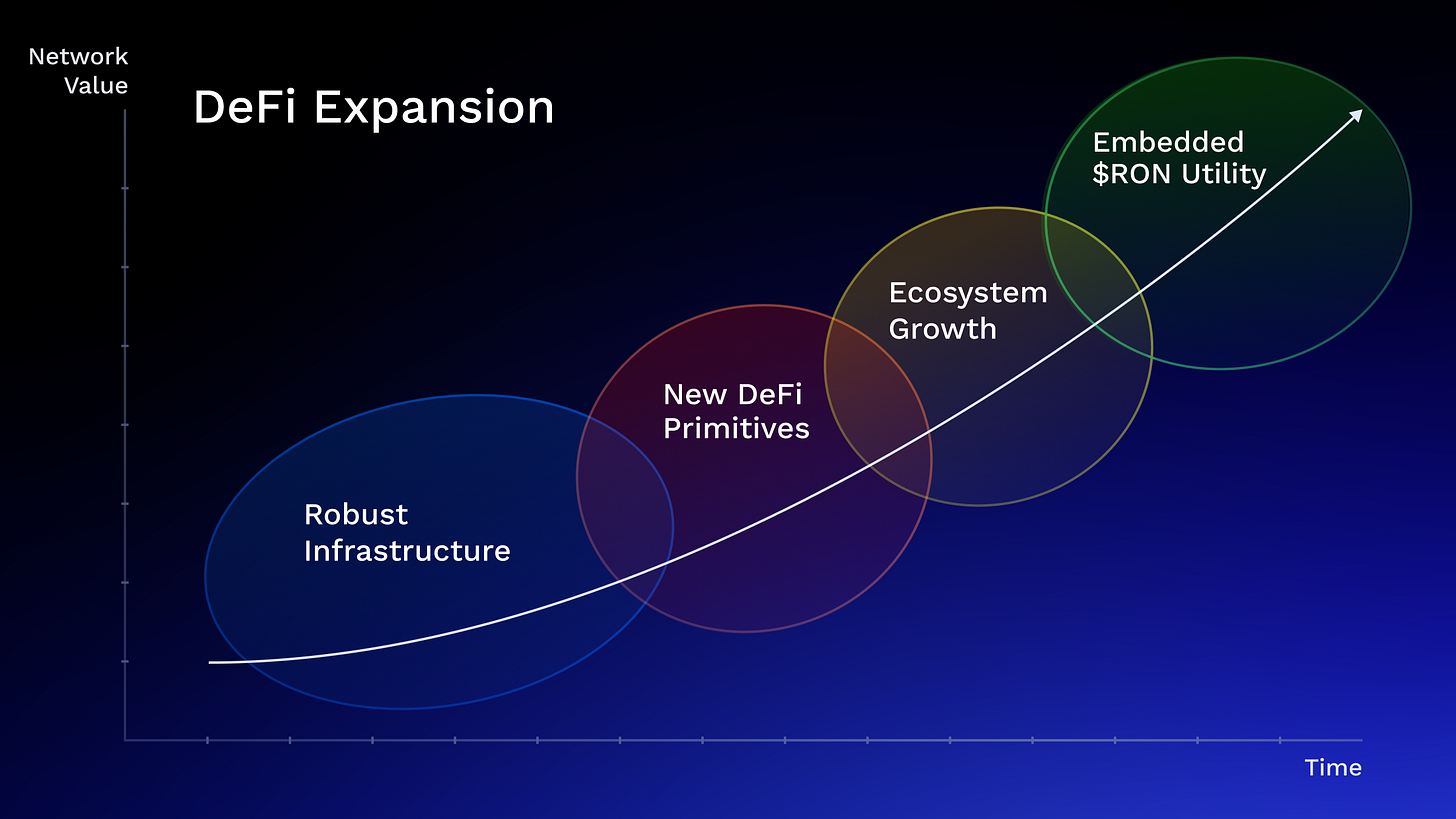

One Mission, Four Phases

We’re taking a phased approach to DeFi expansion, ensuring that each operation and protocol adds strategic value to the ecosystem:

Robust Infrastructure

Ensuring Ronin has strong infrastructure foundations from RPCs to oracles, bridges and more, enabling developers to safely and confidently deploy their DeFi applications. This is crucial to ensure the security of the millions of dollars worth of assets on chain.

New DeFi Primitives

Onboarding reputable blue-chip protocols with proven track records and lindiness to form the backbone of Ronin DeFi. These trusted protocols have garnered users and liquidity over time, and will form the key composable building blocks within our ecosystem. Liquidity bootstraps will help to overcome the cold start challenge, and kickstart the DeFi flywheel to allow for immediate usage on Day 1.

Ecosystem Growth

Focusing on bringing in new DeFi categories and opening up more interesting avenues for what you can do with your capital, including integration into game loops. Builders will launch innovative DeFi applications composed on top of the primitives, while targeted incentives similar to Katana DEX’s liquidity mining program will kick in to provide attractive yields to attract and drive additional capital inflows.

Embedded $RON Utility

As the DeFi ecosystem starts to flourish with free and sustained flow of capital between users and protocols, this last phase focuses on expanding the utility of RON by embedding it into all aspects of Ronin’s virtual economy and positioning it as a high quality asset for users to confidently hold and utilize as collateral across ecosystems.

Final Thoughts

Since 2021, Ronin has spread economic freedom to users of the internet – starting with gamers. Today, DeFi has entered the chat and even more opportunities are coming to RONers. Web3 gaming gives players ownership of their in-game assets, and DeFi introduces new ways to earn with them. Deeper economies. More opportunities. This is more than an extra feature: it’s the engine that will unlock a flurry of new value for both players and builders. Let’s keep pushing.

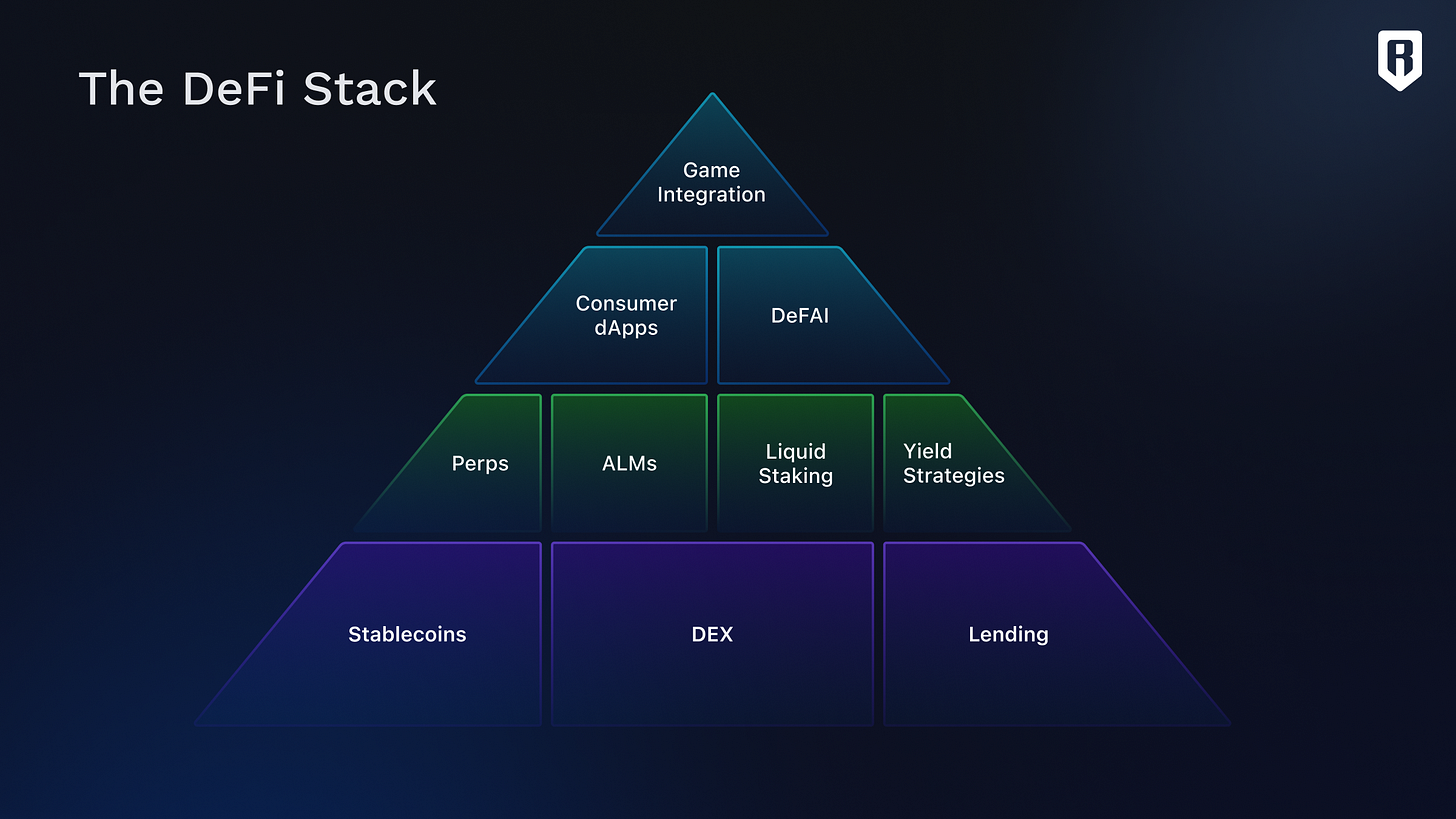

Appendix: Building Blocks of Ronin’s DeFi Stack

DeFi networks go beyond individual applications – they are akin to composable lego blocks that connect and work together. Here’s one way to think about it:

Layer 1: The Foundation

- Stablecoins – These give users the opportunity to transact with confidence, earn steady yield, and minimize volatility. Example: $USDC, $PHPC, and more.

- Decentralized Exchanges (DEXs) – Essential infrastructure providing deep liquidity and enabling seamless swaps. Example: the Katana DEX.

- Lending & Borrowing Markets – Unlock liquidity and earn yield on assets without selling them. Industry leaders like Compound provide low-risk yield opportunities for Ronin users, further explained here.

Layer 2: Yield Strategies & Liquidity Optimization

- Yield Vaults & Looping Products – These curated yield strategies enable users to deposit their assets into vaults and participate in looping to maximize rewards.

- Liquid Staking Derivatives (LSDs) – Put your staked tokens to work and earn more rewards. Unlock the value of staked assets, opening up additional liquidity for DeFi activities. Staked RON and ETH derivatives are just round the corner here.

- Perpetuals DEX – Trade leveraged perpetual futures contracts without expirations through non-custodial, P2P platforms.

- Automated Liquidity Management (ALM) – Seamlessly manage your liquidity positions to maximize yield and minimize risks from impermanent loss.

Layer 3: Gamified DeFi

- Game Integration - Seamless integration of DeFi mechanics within game loops, enhancing real yield opportunities and tokenomics. These dApps naturally weave DeFi elements into gameplay and economies to create rewarding experiences.

- Consumer DApps – Covers a range of applications from Prediction Markets, Memecoin Launchpads, SocialFi - unlocking interactive ways for users to leverage their social capital to participate in financial markets, starting with platforms like Forkast.

- DeFAI – Leverage AI agents to analyze market conditions and autonomously execute on-chain trading strategies, all wrapped in a simple user interface