Key Points

- Ronin’s Homecoming to Ethereum: Ronin is evolving from a gaming-centric, Ethereum sidechain to a full-fledged L2 with a focus on gamified experiences. This upgrade also introduces Proof-of-Distribution, a novel mechanism that rewards long-term builders over short-term mercenaries.

- What this means for YOU: More apps and games. Faster transaction speeds. Stronger security. New ways to support builders via $RON staking. Full details below.

- Timelines: No immediate action required. Governing Validators are reviewing the proposed upgrade and the final hardfork of Ronin’s L2 upgrade is set to be complete by Q1-Q2 2026.

It’s time to come home.

Four years ago, we built Ronin because Axie Infinity needed a faster, more efficient network. Ethereum was still early in its scaling roadmap. Necessity was the mother of our invention.

However, things are different now. Ethereum is BACK. Transaction costs and speeds are better than ever. We’re early to a new era of growth, and Ronin is ready to rise.

Gaming will always be in our DNA, but we’re setting our sights on fulfilling a larger prophecy: becoming the gamification engine of Ethereum.

Ronin will become a full-fledged, Ethereum-aligned L2 by next year, and this is how it’s going to happen.

Becoming Ethereum’s Gamification Engine

Today, Ronin is a gaming-centric chain in the midst of an evolution. The most popular apps are games, but our ecosystem is expanding into gaming-adjacent verticals including gamified DeFi, risk-based SocialFi, tokenized physical collectibles, and even consumer AI. Here’s a look at the numbers:

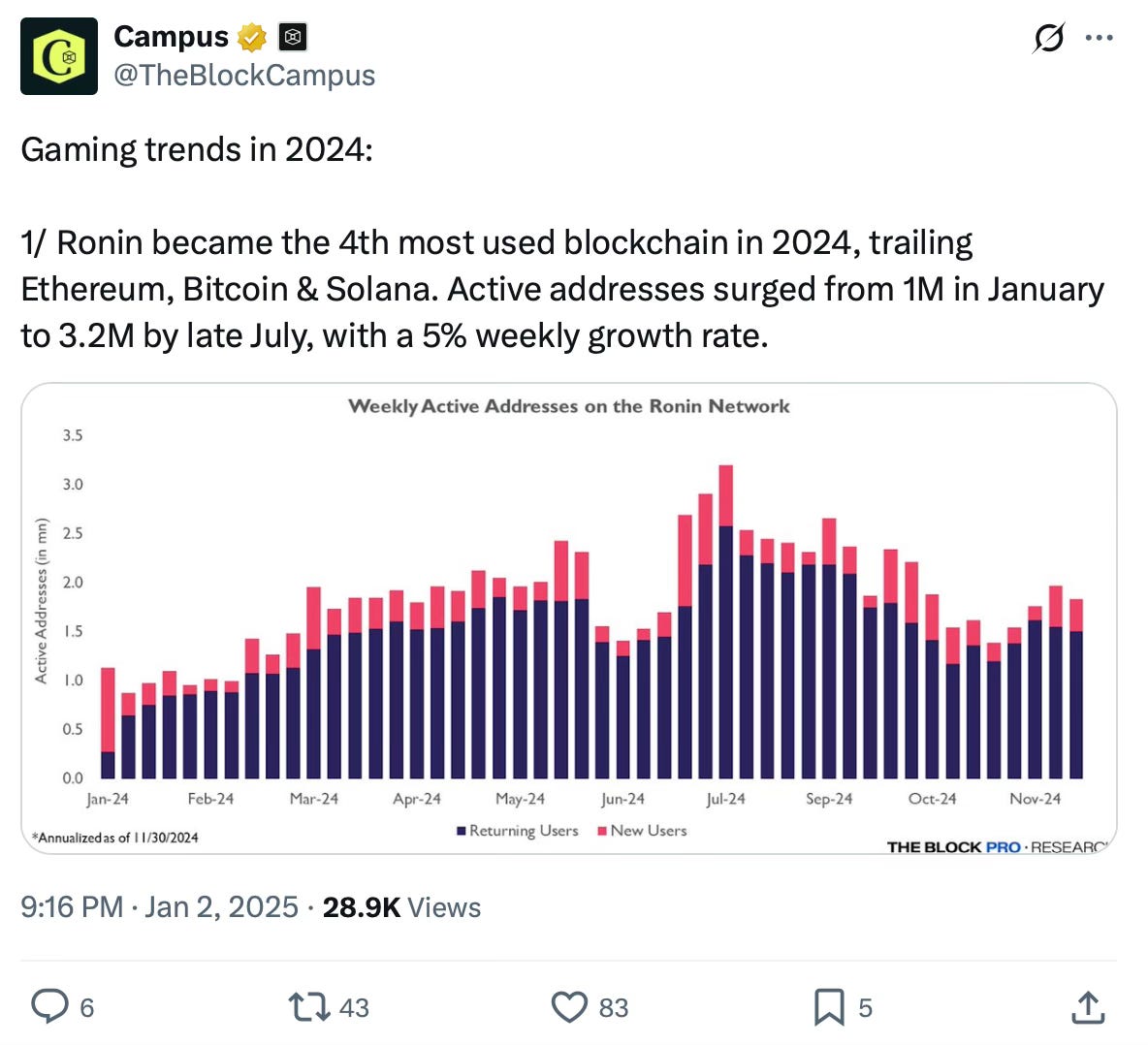

• 4th most-used blockchain of 2024: Over 70 Web3 games launched or migrated onto Ronin

• 31M wallet downloads: Users from the USA, Asia, Europe, and LATAM use Ronin every day

• $4.2B in NFT trading volume on App.axie: The #1 NFT project by all-time volume, verified by the Guinness Book of World Records

• $45M in NFT trading volume on Ronin Market: Over 175 third-party collections are available (see more at Dune Analytics)

• Over 890 wETH in the Ronin Treasury: Plus RON, AXS, and SLP available for community incentives and other purposes

Gaming got us this far. However, our next chapter of growth will ask more of our movement.

We’re seeing early signs of what the future looks like: The onchain blind box experience Jin’s Fortune Spin drove half a million USD in revenue within the first week post-launch. As an L2 on Ethereum, Ronin will be unleashed to keep growing in scope and size.

Why Ethereum?

- The Ethereum Foundation has restructured and is now lean, nimble, and responsive. The new leadership under Tomasz Stańczak is locked-in and impressive.

- Ethereum is winning the war for Wall Street’s attention and capital.

- Running an L2 has become increasingly affordable due to DA solutions like Eigen Cloud.

- Leveraging Ethereum’s security will allow us to make Ronin’s tokenomics more effective.

What this means

• Ronin will become a multi-purpose chain with apps beyond gaming

• Transactions will be 12x faster and Ronin will benefit from Ethereum’s robust security and decentralization

• $RON staking rewards will now reward builders via a new Proof of Distribution model

Introducing Proof of Distribution

Ronin’s Homecoming is an opportunity to adjust our sails before embarking on a new adventure. That’s why we’re revamping $RON’s tokenomics, ensuring rewards flow to builders who earn them. Proof of Distribution is a novel mechanism that re-allocates staking rewards from passive validators → active builders. Here’s how it works:

Over the past couple of years, $RON rewards have flowed to Governing and Regular Validators for securing the network. After this upgrade, $RON rewards will flow to Governing Validators and Contributors. This will reinforce incentives between builders and users, kickstarting a new flywheel with $RON at the center.

Think of a Contributor as a builder. For example, Pixels, Moku, Compound, Ronkeverse, and even Axie Infinity are all Contributors. Many other Regular Validators are also Contributors.

Regular Validators → Stake Managers

Regular Validators will also have the choice to register as Stake Managers. If they register, their and their delegators’ staked RON will migrate to their Stake Manager. If they do not register, these stakes will migrate to a General Stake Manager selected by Governing Validators. In both cases, no action is required from stakers.

Stake $RON → Support Builders

As a result of the Proof of Distribution model, more $RON rewards will go to Contributors and their communities.Contributors will earn rewards based on the size of their total stake and a Builder Score. That will give stakers like YOU a stronger voice in our ecosystem: The more $RON you stake to a Contributor, the more rewards they will receive.

What’s a Builder Score?

Builder Scores will be a combination of a Contributor’s Daily and Monthly Scores. These can account for onchain metrics including gas fees generated, treasury revenue, and TVL as well as off-chain metrics like impressions and mindshare. The more a Contributor does for Ronin, the higher Builder Score they’ll get.

Today, Ronin Validators emit rewards between 8% to 11% APY. However, Contributors may have a much wider range of APY depending on their Builder Scores. This is where Stake Managers come in: They’ll direct users’ stakes towards Contributors with better reward distributions.

Remember: Ronin’s Homecoming will take time. Stay tuned for more detailed Builder Score calculations. Governing Validators are and will be responsible for calculating a Builder's Score to ensure decentralization.

What this means for $RON

Ronin has enormous firepower, but we can only aim so high on our own. This Homecoming will bring our movement closer to Ethereum’s while directing more rewards to top builders. How can gaming-adjacent verticals bring crypto into the everyday lives of our users?

Over the next few years, Ronin will leverage its proven success, institutional relationships, and massive user base in emerging markets to drive more economic freedom than ever. Learn more about Ronin’s future as a payment provider in emerging markets in the FAQ at the end of this article.

Timelines and Roadmap

Ronin’s Homecoming will take place over two phases. Each phase will require the input of Governing Validators, as well as development work from Sky Mavis engineers. The result will usher in new possibilities and opportunities for our movement.

Building on Ronin

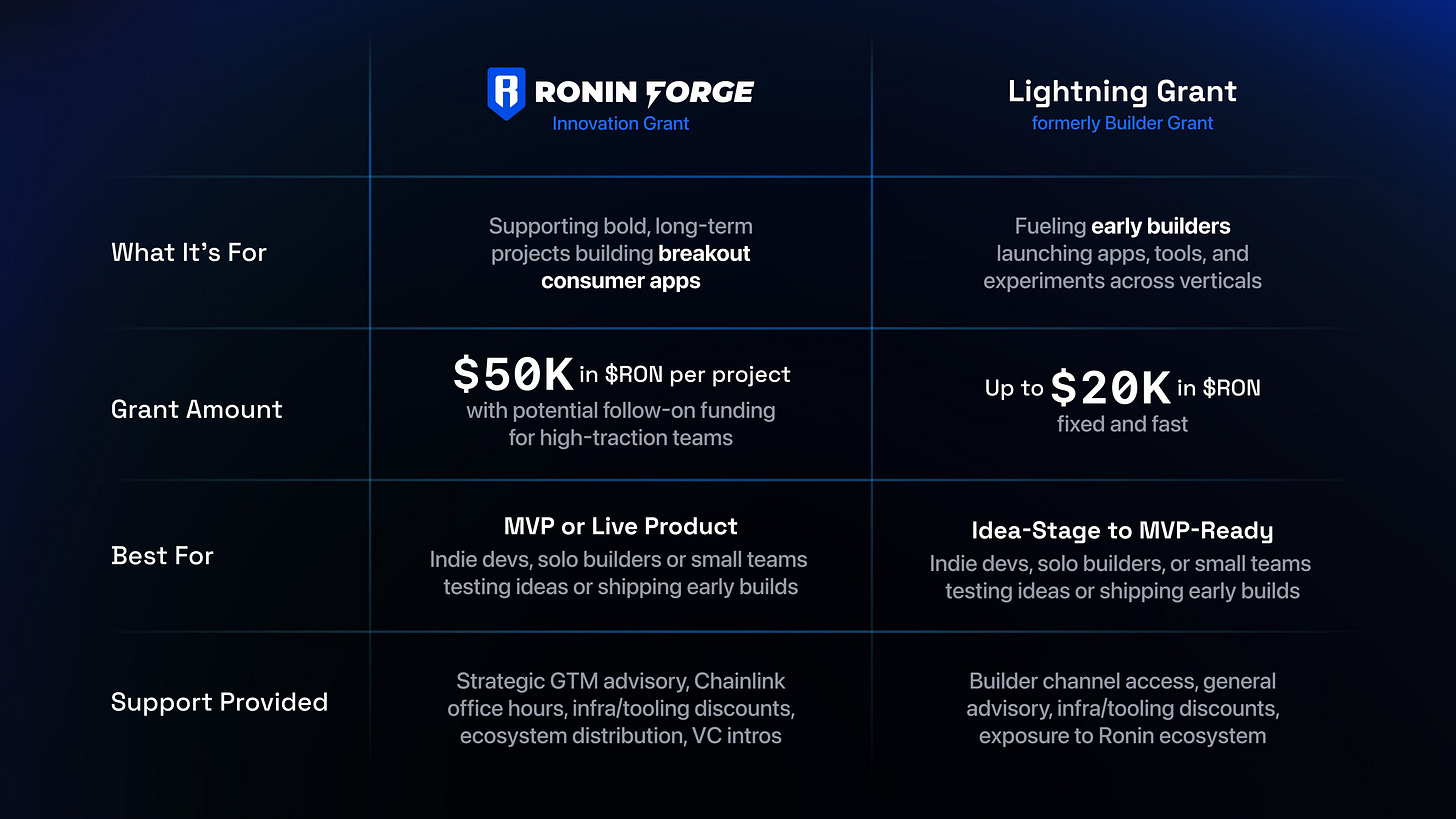

Looking to launch or migrate an app? Check out the grants available for builders. Secure up to $50K in $RON via the Ronin Forge Innovation Grant if your project has shown proven traction. Or get up to $20K in $RON for early stage MVPs and ideas via our revamped Lightning Grants.

Getting Started on Ronin

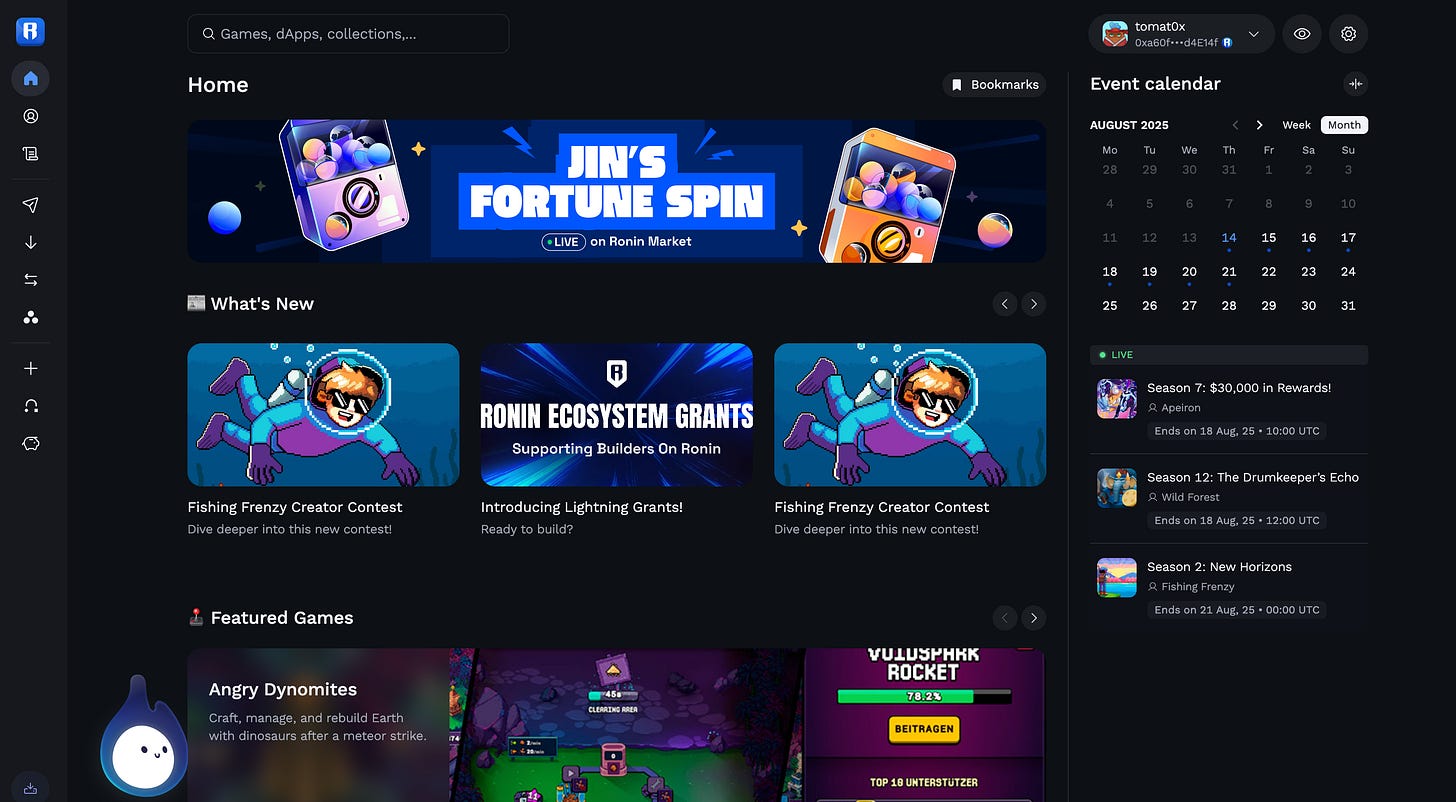

New to Ronin? Download Ronin Wallet and check out the Discovery Page. You’ll find featured games, fresh content, trending token lists, upcoming event info, and more.

The Bigger Picture

This is a full circle moment for us and we’re ecstatic to be coming home to Ethereum.

We also know that technical advancement and traction are just a part of the equation in crypto.

This cycle has been the institutional adoption cycle for crypto. So far, gaming has yet to lean into this.

We are currently leveraging Ronin’s brand recognition, unstoppable community, and unquestionable traction to expand our borders to Wall Street.

Ethereum’s Nintendo deserves nothing less.

FAQ

What does this mean for previous plans of scaling via Polygon zkEVM?

The Ronin ecosystem team chose Polygon zkEVM as an L2 solution on top of Ronin. However, this is a different function from transitioning Ronin into an L2. As a result, the ecosystem team will re-evaluate current and future tech stacks to account for the new plans. Note that Polygon CDK has also been invited to submit a proposal as an L2 provider.

Will Ronin use other tokens like ETH for gas fees?

No, only RON will be used for gas fees.

If there are fewer validators, does that mean Ronin is more centralized/less secure?

No, Ronin will become even more secure after inheriting Ethereum’s industry-leading security and decentralization.

Will this upgrade affect the $RON unlock schedule or circulating supply?

No, nothing has changed. Any potential changes will need to be approved by the GVs.

Can a Validator become a Stake Manager and a Contributor? Will that cause a conflict of interest?

Yes, a Validator can perform both functions and this will not cause a conflict of interest. Consider this fictional example: Broku is a Ronin builder that also runs a Regular Validator today. After the upgrade, they become a Contributor and register as a Stake Manager.

Users will stake to Broku’s Stake Manager, and Broku may opt to direct those rewards to itself as a Contributor. However, the more rewards it directs to itself, the smaller each staker’s share of the total stake will be. This will lower each staker’s APY. The more Broku stakes to itself, the less users will earn. Over time, users would stop staking with Broku.

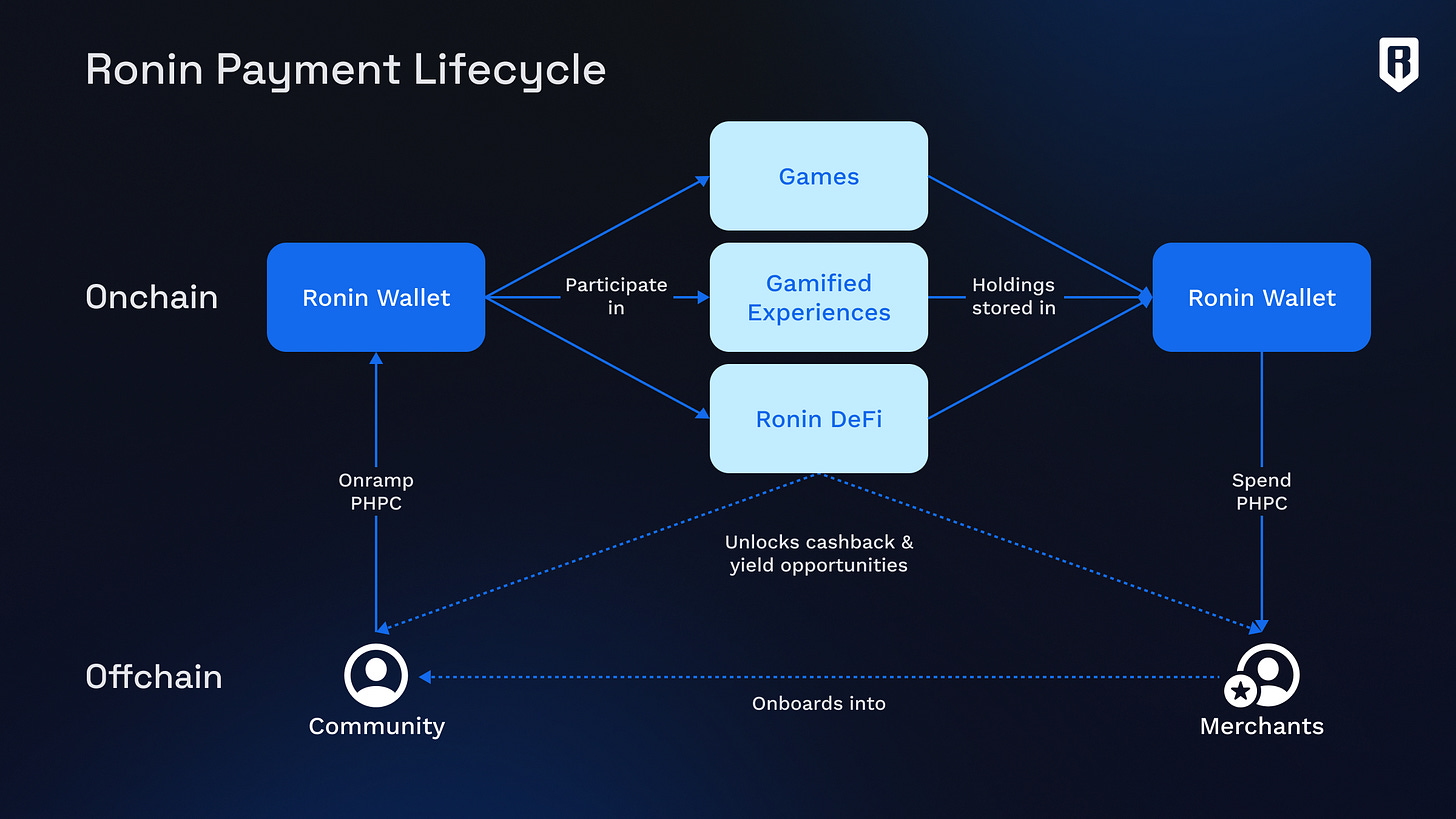

Why and how will Ronin become a payment provider in emerging markets?

The Philippines have long been the beating heart of Web3 gaming, ranking among the top countries in crypto adoption as well. It’s also where Axie Infinity is a household name. A large portion of Ronin users are also based in Vietnam, India, Indonesia, and Brazil. Ronin is well-poised to serve these communities’ needs beyond gaming. How can Ronin bring more sustainable, traditional yield to users? How can Ronin bulldoze barriers between digital and real-world assets?

Sky Mavis teams will be spearheading a new Emerging Markets Payments strategy, starting off in the Philippines. Within Payments, they’ll hone in on Saving, Spending, and later Remittances. Following the Philippines, Ronin will begin to roll out similar payment initiatives and programs across other emerging economies such as Vietnam, Indonesia, Thailand. The core thesis remains where we seek to economically empower and onboard the next wave of users into crypto. These initiatives will begin to roll out in Q4 2025.